Meaning of Debit Note and Credit Note and use in GST

Contents:

The errors occur due to the correct accounts being recorded but on the wrong side. For example, Rs 20,000/- in cash from Mr A was wrongly debited to their account, and a credit entry passed for Cash Book. A credit, on the other hand, is always on the right side of a journal entry.

These why debit is dres use different types of journals based on their operations. However, journals are broadly classified into general and special. Examples like Sales, Discounts Received, Interest Received, Bad Debts recovered , etc. Assets accounts are those accounts which relates to the economic resources of an enterprise such as Land and Building , Plant and Machinery , Furniture, Inventory, Bank and Cash etc. These are further categorized into tangible and intangible and current assets or fixed assets.

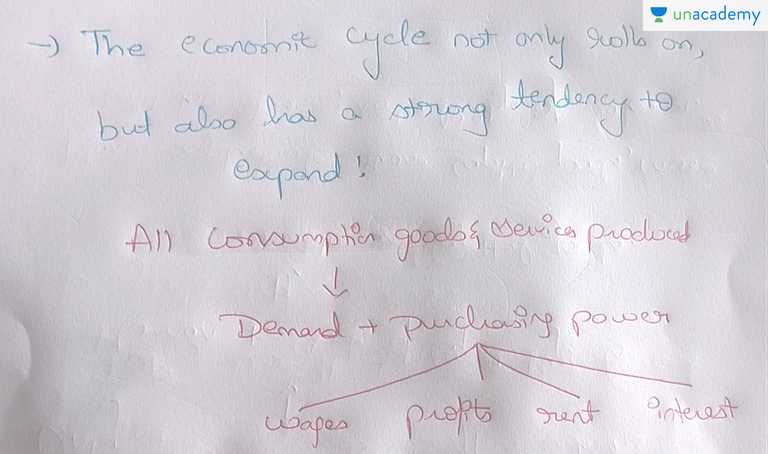

To recall, the utmost rule of debit and credit is that total debits equal total credit which applies to all the totaled accounts. ‚In balance‘ is such an accounting transaction where the total of the debit and credit matches or is equal. In contrast, if the debt is not equal to the credit, creating a financial statement will be a problem. Business transactions are to be recorded and hence, two accounts, which are debit and credit, get facilitated.

Commission: Kiwi Consumers Can Avoid Retail Payment Surcharges – Mirage News

Commission: Kiwi Consumers Can Avoid Retail Payment Surcharges.

Posted: Wed, 03 May 2023 21:10:00 GMT [source]

When a customer deposits money in their account, the bank debits its cash account and credits the customer’s account since now it owes that amount to the customer. The information, product and services provided on this website are provided on an “as is” and “as available” basis without any warranty or representation, express or implied. Khatabook Blogs are meant purely for educational discussion of financial products and services.

As shown above, the ledger accounts are mentioned in the first column, and their various entries are shown as credit or debit entries in the respective columns. Every accounting year has a Trial balance drawn at its end. If needed, such trial balance sheets can also be drawn monthly, half-yearly, quarterly, or even weekly. Its objective is to prove the arithmetic accuracy of its entries since, in a Trial balance, the credit and debit balances are equal. It does not verify the inaccuracies, however, which requires an audit to prove inaccuracies in the credit/debit balances.

Purchased Machinery for Rs 2,00,000 and an advance of Rs 30,000 is paid in cash to M/s Singhania

For example, during the purchase and sale of goods, only two components directly get affected i.e money and stock. But, apart from this we may incur profit or loss out of such transactions and we might incur some expenses for these transactions to happen. These secondary components fall under the Nominal Category and the accounts that are in Profit and Loss statement are shown under this category.

Crediting all the income and gains will increase the capital. On the other hand, the capital reduces when expenses and losses are debited. 50,000In the above table, the first entry is the entry of salary paid. As the salary is a nominal account, the rule is to debit all expenses and cash, being a real account, is credited as the cash payment reduces the asset. General Ledger sums up the financial account transactions and entries in any given period in the prescribed ledger format to quickly ascertain the period’s closing balance. It contains real, personal, and nominal accounts and the entries passed under them reflecting the amounts as credits/debits in the amount column.

Privileges on Doctor’s SBI Card

Her forte lies in investment advisory and strategy with expertise in fundamental analysis and research. CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax.

A transfer journal entry is required to transfer the money from XYZ Co. to the subsidiary account. First, we will understand which accounts are affected in the above transaction. These accounts are the assets account and the owner’s equity account. Debit (Dr.) is to enter an amount of transaction on the left side of a particular account. While, credit is to enter an amount on the right side of a particular account.

On which side does the increase or decrease of the accounts appear? This is answered by studying the ‚normal balance of accounts‘ and ‚rules of debit and credit.‘ Understanding the normal balance will accelerate the learning of the rules. Suppose we purchase machinery for the cash, this transaction will increase the machinery and decrease cash because machinery comes in and cash goes out of the business. Further, this increase in machinery and the decrease in cash are to be recorded in the machinery account and cash account respectively.

Golden Rules of Debit and Credit for Accounting

Hence, in the journal entry, the Loan account will be debited and the Bank account will be credited. Next, the normal balance of all the liabilities and equity accounts is always credited. To increase the account, we will record it on the credit side, and to decrease the account, we will record it on the debit side.

Where the trial balance is cast in the form of an account with credit and debit sides. Both sides have the first column having the account name, amount column, folio column, etc. These transactions reflect the correct amount but on the wrong side and class of accounts. For example, the purchase of a fixed asset car is wrongly reflected in the Expenses Account for motor vehicles, a revenue expense account.

Personal accounts can be considered as a general ledger that relates to people, associations, and companies. Credit Note is a document/voucher given by a party to other party stating that such other party’s account is credited in the books of sender. Sannihitha Ponaka is an MBA graduate from Symbiosis and has more than 5 years of experience in the financial sector. Following her dreams in the field of finance, she leverages writing to communicate the importance of investing. Your go-to guide to creating amazing and easily understood investment content.

- These businesses use different types of journals based on their operations.

- In English & in Hindi are available as part of our courses for Commerce.

- Debit and credit are crucial to the accounting system most entities use today, i.e. the double-entry bookkeeping system.

- Furniture, land, buildings, machinery, etc., are included in real accounts.

Thus, every transaction should be recorded in two accounts. The transaction recorded in two accounts reflect the debit in the account that receives value and credit in the other account that has given value. A journal is one of the accounts where the entries are recorded for the first time using the double entry system. A debit note is issued as proof that a legitimate debit entry has been done by a business while dealing with some other business.

An Account is an outline of business transactions in respect of persons, their representatives and things. At the end of the journal entry, the debit balance should be equal to that of the credit side of the journal entry. The general ledger is the foremost essential of financial reporting. It is used to prepare various financial statements like the income statement, balance sheet, cash flow statement, and so on. A journal can be defined as a book that records the daily transactions. It is a very useful and important book based on the principle of the double entry system of book-keeping.

Key potential symptoms of new Arcturus Covid variant explained by doctor – North Wales Live

Key potential symptoms of new Arcturus Covid variant explained by doctor.

Posted: Mon, 01 May 2023 05:10:00 GMT [source]

Clear can also help you in getting your business registered for Goods & Services Tax Law. The detailed records of accounts maintained under the double-entry system can also be used for comparison purposes. The details of the previous year can be compared with the details of the current year, and any deviations found during comparison can be worked on. Debit cards are more like electronic check that enables the holders to withdraw money from the checking account. Debit cards enable cardholders to withdraw money from any bank’s ATM .

The double-entry system is more transparent and complete. It helps businesses to gain investors and obtain credit easily. The reports prepared by the double-entry system of bookkeeping allow banks and investors to get a complete and accurate picture of the business’s financial health. The Income Tax Department prefers this system of bookkeeping. The statutory bodies governing businesses such as Registrar of Companies, SEBI, RBI, etc., also accept the double-entry system of bookkeeping.

The asset category can be further subdivided into tangible and intangible assets. Two important aspects of accounting are debit and credit. We must only enter a transaction after understanding the detailed meaning of which account should be debited or credited. Applying the golden rules of accounting will help you determine the journal entries.

Compound Entries These entries record more than one account to be credited or debited. Such entries need not follow the rule of journal entry and hence their number of debits and credits may not be equal. Reversing Entries These entries are made at the beginning of a new accounting period and serve to reverse or undo an adjusting entry made at the end of the previous accounting year. In accounting, every transaction has a dual entry – debit and credit. It is important to identify which account has to be credited and which one debited.

Some examples of personal accounts are customers, vendors, salary accounts of employees, drawings and capital accounts of owners, etc. A debit is an entry made on the left side of a journal or ledger which increases an asset and expense, and decreases a liability, revenue, and capital. A credit is an entry made on the right side of a journal or ledger which increases a liability, revenue, and capital and decreases an asset and expense. Expenses and assets are accounted for as debit balances, while income and liabilities are considered credit balances. Locating ledger and journal errors or inefficiencies in the many stages of the accounting system.

The most important point to note about journal entries in accounting is that they follow the double-accounting method. That means, for every recorded entry two different accounts are affected. This is one of the three golden rules of accountancy in which the receiver is debited and the giver is credited.

-

Overall Score

Reader Rating: 0 Votes